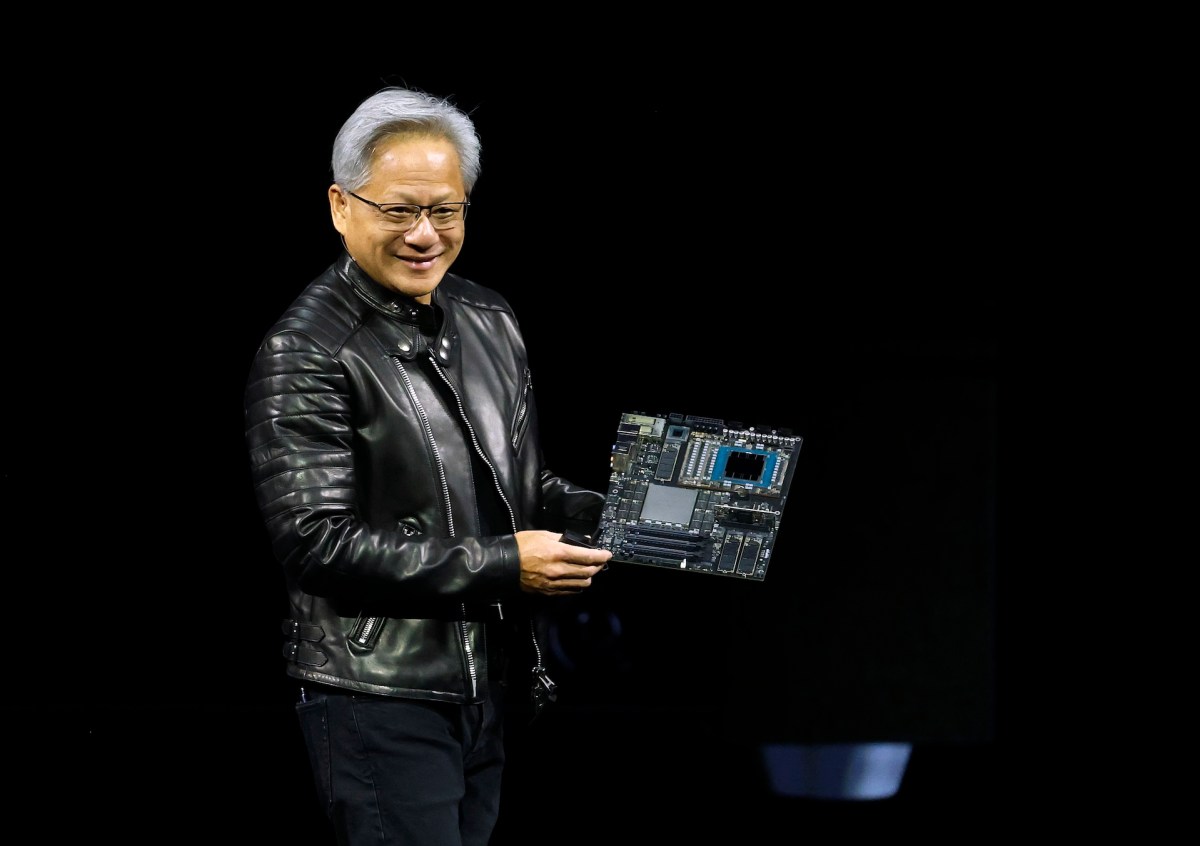

Jensen Huang, Nvidia’s founder and CEO, expressed optimism during the company’s third-quarter earnings report. The company’s performance suggests this optimism may be justified.

Nvidia announced $57 billion in revenue for the third quarter, marking a 62% increase compared to the same period last year. The company’s net income, calculated on a GAAP basis, reached $32 billion, a 65% rise year-over-year. Both revenue and profit figures exceeded Wall Street forecasts.

The revenue breakdown reveals a company thriving, largely due to its data center segment. Nvidia’s data center business generated a record $51.2 billion in revenue, a 25% increase from the previous quarter and a 66% increase from the prior year. The remaining revenue came from Nvidia’s gaming business at $5.8 billion, followed by professional visualization and automotive sales.

Nvidia’s CFO, Colette Kress, stated that the data center business has been boosted by accelerated computing, advanced AI models, and agentic applications. During the Q3 call, Kress noted that the company announced AI factory and infrastructure projects totaling 5 million GPUs in the past quarter.

“This demand spans every market, CSPs, sovereigns, modern builders enterprises and super computing centers, and includes multiple landmark build outs,” Kress stated.

Blackwell Ultra, a GPU introduced in March and offered in various configurations, has performed particularly well and is now a leader for the company. The company also noted continued high demand for previous versions of the Blackwell architecture.

Huang commented that sales of its Blackwell GPU chips “are off the charts.”

Techcrunch event

San Francisco

|

October 13-15, 2026

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said during the company’s Q3 earnings statement. “Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

Kress mentioned that the company’s shipments of H20, a data center GPU for generative AI and high-performance computing, reached 50 million, which was a disappointing outcome due to restrictions on sales to China.

“Sizable purchase orders never materialized in the quarter due to geopolitical issues and the increasingly competitive market in China,” Kress stated on the earnings call. “While we were disappointed in the current state that prevents us from shipping more competitive data center compute products to China, we are committed to continued engagement with the U.S. and China governments, and will continue to advocate for America’s ability to compete around the world.”

Notably, Nvidia anticipates further growth, projecting revenue of $65 billion in the fourth quarter, which drove its share price up by over 4% in after-hours trading.

The takeaway, according to Huang: disregard bubble concerns and focus on growth.

“There’s been a lot of talk about an AI bubble,” Jensen stated during the company’s earnings call. “From our vantage point, we see something very different.”