In India, Google is enhancing its AI capabilities to combat digital fraud by introducing on-device scam detection for Pixel 9 devices and new screen-sharing alerts for finance-related apps.

As more individuals in India access the internet for the first time and increasingly utilize smartphones for payments, shopping, and government services, digital fraud continues to escalate. According to the Reserve Bank of India (RBI), digital transaction fraud accounted for over half of all reported bank fraud in 2024, comprising 13,516 cases with losses amounting to ₹5.2 billion (approximately $58.61 million). The Ministry of Home Affairs reported that online scams resulted in estimated losses of ₹70 billion (around $789 million) in the first five months of 2025. Many instances likely go unreported, either due to victims’ uncertainty about filing complaints or their desire to avoid added scrutiny.

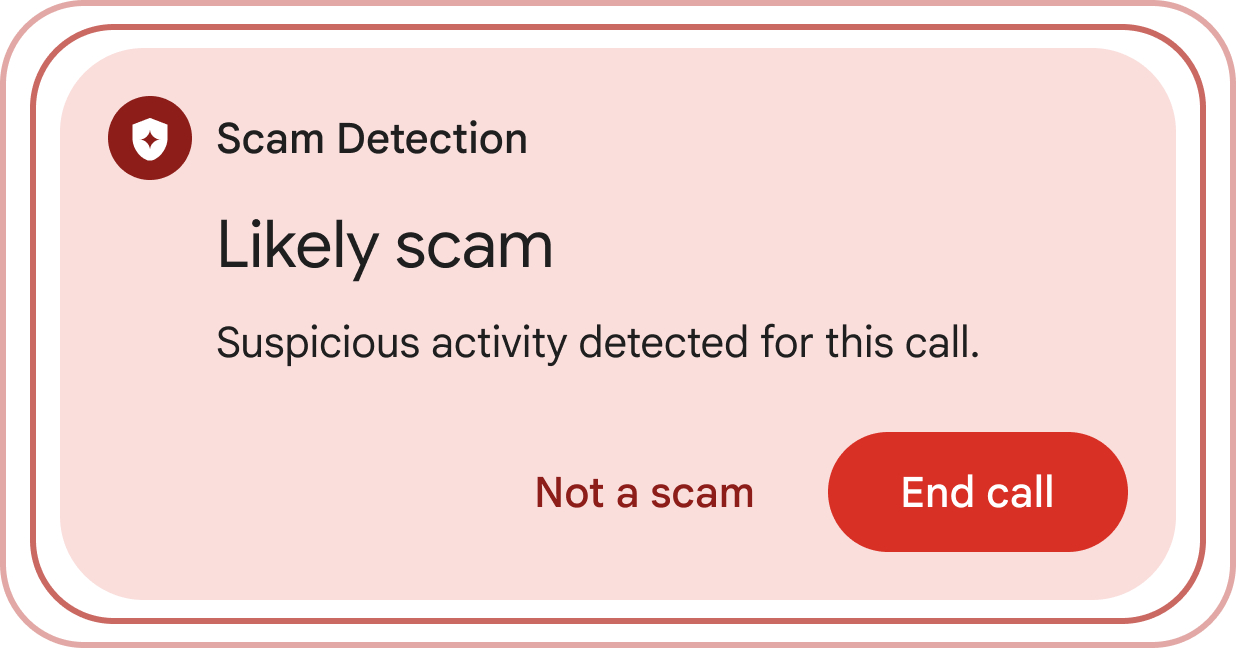

On Thursday, Google revealed the expansion of its real-time scam-detection feature. This feature employs Gemini Nano to analyze calls directly on the device, identifying potential fraud without storing audio or transmitting data to Google’s servers. Enabled by the user, it functions solely for calls from unidentified numbers and emits a beep sound during the conversation to inform participants. This feature was initially launched in the U.S. in March as a beta for Pixel 9 users who speak English.

Google has confirmed with TechCrunch that its on-device scam detection will initially be available only on Pixel 9 and newer models in India. It will also be restricted to English-speaking users, with warnings displayed only in English. This limits its scope in a market where Android is used on nearly 96% of smartphones, according to Statcounter, while Pixel devices had less than a 1% share in 2024. The language restriction is also significant in a country where a majority of users primarily use languages other than English — a demographic that Google and other companies like Amazon have addressed by including Indian language support across their platforms in recent years.

The tech giant also stated its intent to expand scam detection to non-Pixel Android devices, though no specific timeframe was provided.

Google also announced a pilot program in India with financial applications such as Navi, Paytm, and Google Pay to reduce screen-sharing scams. These scams involve fraudsters tricking victims into sharing their screens, enabling them to steal one-time passwords, PINs, and other sensitive information during a phone call. This initiative was first mentioned at Google I/O in May and initially tested in the U.K.

Users with Android 11 or later can utilize the alerts, which feature a one-click option to end the call and stop screen sharing. Google has confirmed to TechCrunch that it plans to include more app partners and will provide alerts in Indian languages as well, but no further information was given.

Techcrunch event

San Francisco

|

October 13-15, 2026

Google has also been utilizing its Play Protect service for several months to limit predatory lending apps in India by preventing the sideloading of third-party apps that request sensitive permissions, which are often misused for fraud. The company reported that this service has blocked over 115 million such installation attempts this year. Additionally, Google Pay displays more than a million warnings each week for transactions considered potentially fraudulent, according to the company.

Google is also conducting its DigiKavach campaign to raise awareness about digital fraud, which it reports has reached over 250 million people. The company has collaborated with the Reserve Bank of India to release a public list of authorized digital lending apps and their associated non-banking financial companies to help minimize the impact of malicious entities.

Earlier this year, Google introduced a Safety Charter in India to broaden its AI-driven fraud detection and security initiatives, as part of a larger effort to implement additional AI tools in the nation to combat increasing fraud.

However, Google still encounters notable challenges in its efforts to curb digital fraud in India. The company, along with Apple, has faced scrutiny for permitting deceptive and misleading apps to be listed on its app store, despite review processes intended to prevent fraudulent submissions.

In recent years, law enforcement and security experts have identified investment and loan apps involved in scams that remained accessible on the Play Store until intervention occurred. These instances highlight the difficulties Google faces in regulating an ecosystem that dominates the smartphone market in the country.