As you’ve been preoccupied with Thanksgiving preparations, notable investor Michael Burry – of “The Big Short” fame, played by Christian Bale – has been escalating his opposition to Nvidia.

This is a noteworthy conflict, as Burry might actually prevail. Unlike other AI bubble warnings, Burry now possesses both a significant audience and the freedom from regulatory limitations to potentially instigate the very downturn he anticipates. He is not only betting against the AI surge but also actively attempting to persuade his expanding follower base that Nvidia’s success is an illusion.

The question now is whether Burry can generate sufficient doubt to significantly hinder Nvidia and, consequently, other key players like OpenAI.

Burry has intensified his efforts recently, launching attacks on Nvidia and engaging in heated exchanges with Palantir CEO Alex Karp after filings revealed Burry’s billion-dollar bearish put options on both firms, anticipating their decline. (Karp dismissed Burry’s strategy as “batshit crazy” on CNBC, prompting Burry to mock Karp’s understanding of SEC filings.) This dispute highlights the market’s fundamental disagreement: whether AI will revolutionize everything, justifying current investments, or if we are in a mania destined for a negative outcome.

Burry’s accusations are precise and severe. He claims Nvidia’s stock-based compensation has cost shareholders $112.5 billion, effectively halving owner’s earnings. He also suggests AI companies are manipulating their financials by delaying depreciation on rapidly depreciating equipment, arguing that Nvidia’s customers are exaggerating the lifespan of Nvidia’s GPUs to justify excessive capital spending. Regarding the supposed customer demand, Burry essentially alleges it’s a facade, with AI customers “funded by their dealers” through a circular financing arrangement.

Given the attention Burry has garnered, Nvidia, despite its strength and impressive earnings report last week, felt obligated to respond. In a seven-page memo from Nvidia’s investor relations team to Wall Street analysts, initially reported by Barron’s, the company countered Burry’s claims, stating his calculations were incorrect, particularly his inclusion of RSU taxes, claiming the actual buyback figure is $91 billion, not $112.5 billion. Nvidia also asserted that its employee compensation aligns with industry standards and firmly denied any resemblance to Enron.

Burry’s succinct response: he wasn’t comparing Nvidia to Enron but to Cisco in the late 1990s, when excessive infrastructure development led to a 75% stock crash upon realization of oversupply.

Techcrunch event

San Francisco

|

October 13-15, 2026

This situation might seem minor by next Thanksgiving, or it might not.

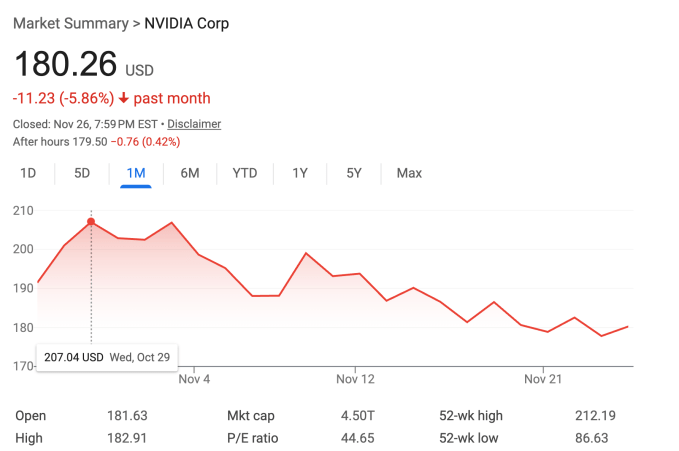

Nvidia’s stock has surged twelvefold since early 2023, reaching a market capitalization of $4.5 trillion, marking the fastest ascent to becoming the world’s most valuable company.

However, Burry’s history is mixed. While his correct prediction of the housing crisis earned him recognition, his consistent predictions of various collapses since 2008 have led critics to label him a “permabear,” causing his devoted followers to miss significant market upswings. He made an early, astute investment in GameStop but sold before its meme stock surge and lost heavily by shorting Tesla. Despite his accurate housing crisis forecast, frustrated investors withdrew from his fund due to prolonged underperformance.

Earlier this month, Burry deregistered Scion Asset Management, his investment firm, with the SEC, citing “regulatory and compliance restrictions” that hindered his communication, expressing frustration with misinterpretations of his tweets on X.

Last weekend, he introduced “Cassandra Unchained,” a Substack newsletter, to advance his arguments against the AI industry. The newsletter, priced at $400 annually, promises a “front row seat to his analytical efforts and projections for stocks, markets, and bubbles, often with an eye to history and its remarkably timeless patterns,” representing Burry’s primary focus.

His audience is growing, with the newsletter gaining 90,000 subscribers in under a week, raising the critical question: Is Burry a warning signal for an unavoidable collapse, or could his fame, history, unrestricted communication, and expanding audience initiate the very downfall he predicts?

History suggests this is plausible. Jim Chanos’s criticisms of Enron’s accounting practices in 2000 and 2001, while not creating the fraud, authorized other investors to scrutinize the company, accelerating its demise. Similarly, David Einhorn’s detailed analysis of Lehman Brothers’ accounting methods at a 2008 conference increased investor skepticism, potentially contributing to the loss of confidence that led to its collapse. In both instances, underlying issues existed, but a respected critic with a platform created a crisis of confidence, becoming a self-fulfilling prophecy.

If investors believe Burry’s assessment of AI overbuilding, they might sell, validating his bearish view. More investors could follow suit. Burry doesn’t need to be entirely accurate; he only needs to be convincing enough to incite a rush to sell. Nvidia’s November performance suggests Burry’s warnings are resonating, while its year-long performance presents a less clear picture.

What’s evident is that Nvidia faces significant potential losses, including its massive market capitalization and its status as the indispensable company of the AI era, while Burry risks only his reputation and now possesses a powerful platform he’s likely to use extensively.