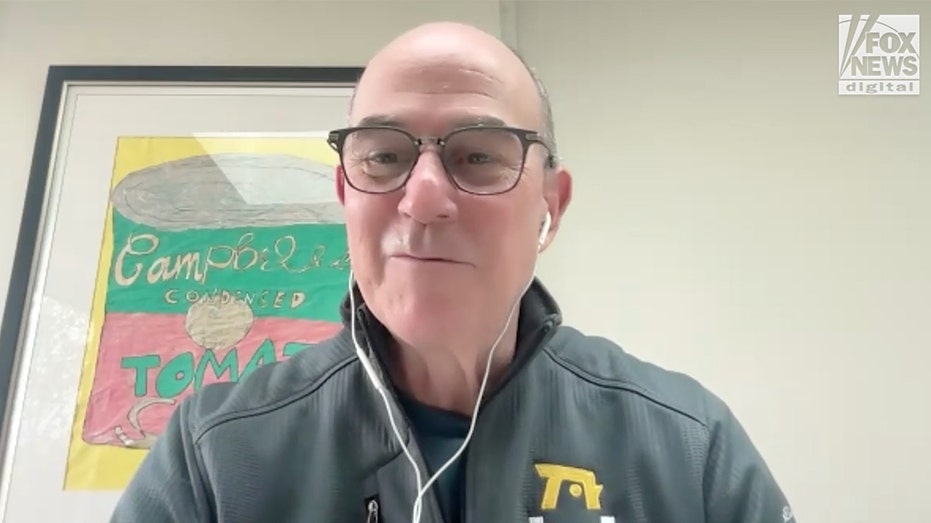

‘The Big Money Show’ discusses the potential fallout from President Donald Trump’s proposed credit card interest rate cap.

JPMorgan Chase Bank recently admitted it closed President Donald Trump’s bank accounts following the Jan. 6, 2021, breach of the U.S. Capitol, a confession spurred by a $5 billion legal challenge from the president last month.

The suit, brought against the bank and its CEO, Jamie Dimon, in Miami state court, accused the financial institution of debanking Trump for political reasons.

In a new court filing, Dan Wilkening, chief administrative officer for global banking at JPMorgan, confirmed that in February 2021, the bank informed Trump and several of his hospitality companies that certain accounts would be closed.

Copies of formal letters sent by JPMorgan are dated Feb. 19, 2021.

TRUMP SUES JPMORGAN CHASE AND CEO JAMIE DIMON FOR $5B OVER ALLEGED ‘POLITICAL’ DEBANKING

Marquee at the main entrance to the JPMorgan Chase Headquarters Building in Manhattan. (Erik McGregor/LightRocket via Getty Images / Getty Images)

One letter addressed to Jeffrey McConney, of The Trump Corporation, explicitly states, “JPMorgan Chase Bank, N.A. (‘we’) has decided to close its banking relationship with The Trump Corporation and its affiliated entities.”

Another letter addressed directly to Trump states, “We may determine that a client’s interests are no longer served by maintaining a relationship. … With that in mind, this letter is to respectfully inform you that we will need to end our current relationship.”

Wilkening claimed the bank handled the remaining balances in the accounts by working with Trump and his companies to move their funds to other institutions, in accordance with the bank’s standard account agreements.

Trump and his companies were given until April 19, 2021, to transfer hundreds of millions of dollars before the accounts were officially closed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 310.79 | +2.74 | +0.89% |

TRUMP SAYS HE WILL SUE JPMORGAN CHASE OVER ‘INCORRECT’ POST-JAN 6 DEBANKING

His attorneys alleged that Bank of America later refused to accept large deposits when he attempted to bank elsewhere.

While the bank’s letters do not provide a specific reason for the closures, Trump attorneys are alleging the accounts were “unlawfully closed due to political discrimination” and that they were placed on a “blacklist.”

In an earlier filing, Trump’s attorneys noted he was a JPMorgan customer for decades, and he and his affiliated entities transacted “hundreds of millions of dollars” through the bank.

Based on account agreements JPMorgan shared with the court, the institution can justify closing certain accounts, with or without cause, and generally permit either party to terminate accounts with at least 30 days written notice.

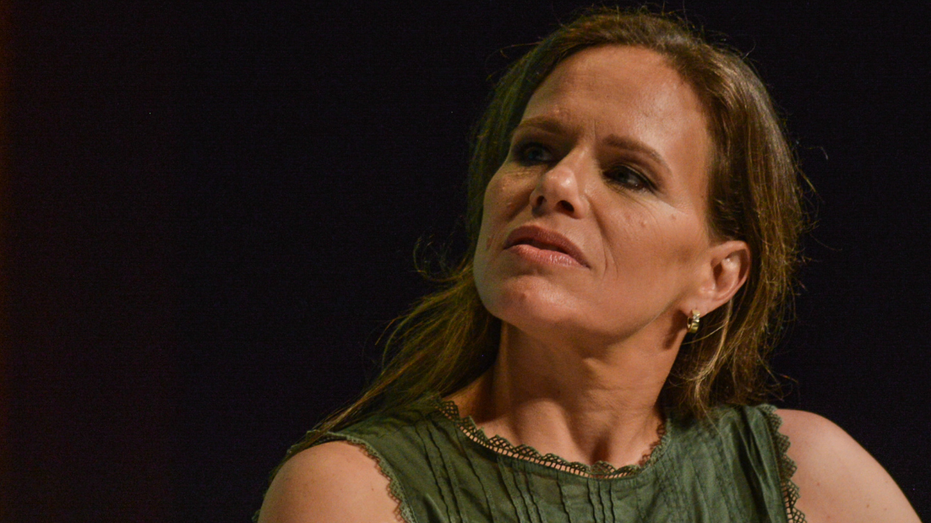

Jamie Dimon, chief executive officer of JPMorgan Chase & Co., speaks during the America Business Forum in Miami, Nov. 6, 2025. (Eva Marie Uzcategui/Bloomberg via Getty Images / Getty Images)

The agreements also authorize closure upon written notice of specific reasons, including breach of contract, financial impairment or insolvency, legal or regulatory requirements, or activities the bank in “good faith” believes violate its policies.

JPMorgan’s policies are primarily structured around regulatory compliance and risk management, specifically anti-money laundering and anti-terrorism, government sanctions, unlawful transactions, and adherence to general legal and banking standards.

The agreements note customers must comply with all notified bank policies, and the bank reserves the right to refuse transactions, freeze funds or close accounts without further notice if it determines an activity conflicts with its policies.

Trump’s attorneys are accusing JPMorgan Chase and its CEO of trade libel, violating Florida’s unfair and deceptive trade practices act, declaratory relief and breach of implied covenant of good faith and fair dealing — demanding a jury trial.

TRUMP ORGANIZATION, ERIC TRUMP SUE CAPITAL ONE FOR ‘UNJUSTIFIABLE’ 2021 DEBANKING BASED ON ‘WOKE’ BELIEFS

Lawyers said they are “confident that JPMC’s unilateral decision came about as a result of political and social motivations, and JPMC’s unsubstantiated, ‘woke’ beliefs that it needed to distance itself from President Trump and his conservative political views.”

“In addition to the considerable financial and reputational harm that Plaintiffs and their affiliated entities suffered, JPMC’s reckless decision is leading a growing trend by financial institutions in the United States of America to cut off a consumer’s access to banking services if their political views contradict with those of the financial institution,” Trump’s attorneys wrote in the initial complaint.

Dimon in 2025 denied that his institution debanks customers based on political views.

President Donald Trump had been a customer of JPMorgan for decades, according to the lawsuit. (Krisztian Bocsi/Bloomberg via Getty Images; ANGELA WEISS/AFP via Getty Images / Getty Images)

“We don’t debank people because of political or religious affiliations,” Dimon said on Capitol Hill Feb. 13, 2025. “But there are a lot of things that can be fixed. We should fix them. The rules and requirements are so onerous, and it does cause people to be debanked in my opinion, should not be debated.”

The Trump Organization also sued Capital One in 2025, claiming the bank in 2021 “unjustifiably” terminated more than 300 of its bank accounts, and accounts belonging to Trump family members.

At the time, a Capital One spokesperson told Fox News Digital, “Capital One has not and does not close customer accounts for political reasons.”

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

JPMorgan Chase did not immediately respond to FOX Business’ request for comment.

FOX Business’ Brooke Singman contributed to this report.