According to global VC firm Accel’s 2025 Globalscape report, which concentrates on the AI and cloud market, the U.S. leads Europe in the development of large AI models; however, the application layer presents a different scenario, showcasing emerging category leaders like Lovable and Synthesia. (It’s worth noting that Accel has invested in both Lovable and Synthesia.)

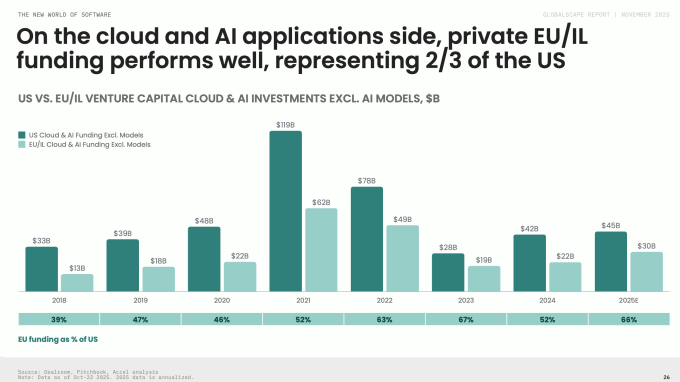

Interestingly, European and Israeli cloud and AI applications have garnered 66% of the private funding received by their American counterparts thus far in 2025. Accel partner Philippe Botteri remarked to TechCrunch, “A decade ago when we initiated this report, Europe’s share was just one tenth of that of the U.S.”

According to Botteri, this growth in ratio is thanks to the establishment of an ecosystem of founders and investors in the region “who truly grasp how to develop exceptional software companies, and this virtuous cycle has been ongoing for a decade.”

It also highlights the capacity of Europeans and Israelis to contribute to staffing Big Tech AI labs — an observation also made by Jonathan Userovici, a general partner based in Paris at Headline. Userovici stated to TechCrunch, “Across all sectors, from law and healthcare to manufacturing and marketing, we are seeing founders uniting top-tier technical expertise with profound market understanding.”

This is consistent with the results of the AI Europe 100 report issued by Headline earlier in the year, which showcased AI-driven application startups across Europe that it believes possess “the capacity to emerge as Europe’s future leaders” due to a combination of team, growth velocity, and advancements in tech.

Accel also identifies growth velocity as a primary distinction between this AI wave and previous iterations. It now takes only a few years for a new generation of AI-driven applications to reach $100 million in annual recurring revenue, a milestone that previously took decades to achieve.

Botteri stated, “They are expanding at a rate faster than anything we have seen before, and they are accomplishing this with remarkable efficiency, meaning that revenue per employee is the highest we have ever recorded for software companies. And this is happening on both sides of the Atlantic.”

Techcrunch event

San Francisco

|

October 13-15, 2026

However, he pointed out that “existing cloud software companies are not disappearing.” Accel’s Public Cloud Index has increased by 25% year-over-year, and these companies are “all incorporating agentic capabilities into their products.” He asserted that certain private companies are integrating AI so rapidly that they could be seen as AI-native, citing Accel portfolio company Doctolib as an example.

Although Europe has maintained considerable optimism for local foundation model companies such as Mistral AI, Accel is less optimistic about European model companies. Nevertheless, Botteri did not entirely dismiss the space as a potential breeding ground for future leaders, as this could still occur for smaller models. He simply stated, “it is not a particularly target-rich setting.”

Conversely, VCs are aggressively vying for investment prospects in the AI application layer, in spite of ongoing concerns regarding defensibility. Botteri maintains that creating a product-focused offering with rapid adoption still provides defensibility.

Another misconception is the notion that there is no opportunity beyond models and applications. Lotan Levkowitz, a managing partner at Israeli VC firm Grove Ventures, stated, “We observe that the majority of the market is currently focused on models, compute, and actions, and we believe that data is currently undervalued. We firmly think that companies emphasizing proprietary data and data flywheels are indeed highly profitable.”